How to understand the purchase behavior of consumers – A Google research

Article preview: The purchase behavior of consumers is a complex decision-making process that uses cognitive biases deeply ingrained in our pre digital history. In a recent research, Google identifies a stage where consumers decide what to buy and from whom, called the “Messy Middle” – a space between need awareness and purchase, with unlimited choices and information, which buyers have learned to manage through a series of cognitive shortcuts.

Identifying the “Messy Middle” stage

Cheap, or best?

For this study, Google researchers used one of the most valuable resources they have: Google Trends. There are billions of searches on Google every day, and 15% of these searches are completely new.

For example, in the process of buying a laptop, we are not searching for any laptop, but “the best” laptop – whatever we may mean by that. These additional words used when searching for a product are called search modifiers.

From this category of terms, search interest for “cheap” has significantly declined in the past 15 years, while the term “best” has far outpaced it.

Riders and elephants

Metafora călărețului (partea analitică, rațională) și a elefantului (partea emoțională) explică foarte bine mecanismele gândirii. Călărețul este în general responsabil de direcția în care se merge, însă în momentul în care apare un stimul care îi atrage atenția elefantului, se poate observa ce puțin control are de fapt. Această analogie este baza multor cercetări pe tema comportamentului de cumpărare a consumatorului.

For the present research, Google analyzed the behavior of 310 respondents who chose from 31 product categories. Audiovisual recording was used while buyers talked about decision-making factors in the buying process.

Research findings, drew on a Post-It Note

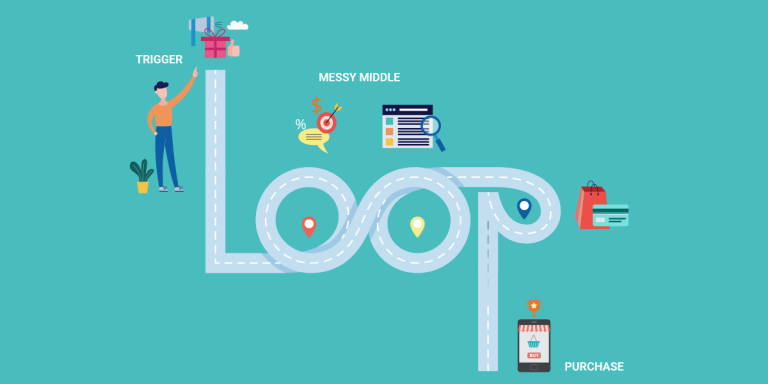

To describe what they found, the researchers marked the trigger – the need’s awareness – and the purchase itself. In between, they came up with the drawing below – a stage in the process called the “Messy Middle”.

Exploring and evaluating

The sequence of looking for products and then weighing options equates to two different mental models: exploration and evaluation. These two models are the key to understanding the “Messy Middle”.

Exploration is an expansive activity, while evaluation is inherently reductive. When we explore, we consider different brands, products, while when we evaluate, we narrow down our options.

Show… me… the… Model!

Between the Trigger and Purchase poles, sits the messy middle, in which consumers loop between exploring and evaluating the available options, until they are ready to purchase.

Searching for clues in Google Trends

The research team noticed that the way the search engine has been used has changed in recent years:

- In the 2000s, the word “free” was king in Google searches in the UK. Mostly, the term was used when searching for free entertainment, such as games, music, and movies.

- The term “cheap” was also widely used in the early 2000s, but in time, there has been a decline, as opposed to the term “best”, which is constantly growing.

OK Google, let’s go shopping

Following the analysis of the seven main search modifiers worldwide: “ideas”, “best”, “difference between”, “cheap”, “deals”, “reviews”, and “discount codes”, the researchers found that:

- Searches containing the term “ideas” are associated with an exploration mindset.

- Searches related to the ‘’travel’’ category containing the term ‘’cheap’’ rarely include a brand name. Even if we consider the “cheap” searches to be evaluative, the absence of brands shows us that these might also be exploratory.

- The term “deals” is especially common in the telecom and internet sector. We use this modifier to seek value when we are exploring and evaluating this type of service.

- We use the term “offers” in retail related searches, especially when it comes to relatively pricey products, such as alcohol.

- Conversely, the term “sale” tends to be associated with certain retail categories, such as clothing and furniture.

- There is a difference between searches containing “best” and “reviews”. Searches containing “best” rarely include the name of a brand, while searches containing “reviews” often do.

- Searches containing “discount code” and “promo code” have grown over the past 10 years, spiking in November and December.

- The proportion of worldwide searches containing “free” and “cheap” has been in decline, while the proportion containing “best” has been increasing.

- The proportion of searches containing “the best” (“cel mai bun”), “the cheapest” (“cel mai ieftin”), and “free” (“gratuit”) in the past 6 years in Romania is equal to the global proportion.

How can we influence the “Messy Middle”?’

Homo-not-so-economicus

Research shows that any kind of purchase, even buying a common and low-cost product, like shampoo, can be prompted by emotional or rational considerations.

The 6 cognitive biases that can increase the interest and purchase rates are:

- Category heuristics – shortcuts or rules of thumb that help us in making a quick and satisfactory decision. For example: focusing on how many megapixels the camera has when purchasing a smartphone.

- Authority bias – the tendency to alter our opinions or behaviors to match those of someone we consider to be an authority on a subject.

- Social proof – the tendency to copy an action or a behavior that seems to be a popular choice. It is very likely to click on an ad that includes a four- or five-star rating.

- Power of now – describes the fact that we tend to want things now rather than later.

- Scarcity bias – is based on the economic principle that a rare or limited resource is more desirable.

- Power of free – describes the fact that there is something special about a price equal to zero.

Testing the 6 biases

The purpose of this simulation is understanding how the marketing strategies effectiveness can be improved in the “Messy Middle” stage, using behavioral science principles to either avoid or create disrupted brand preferences.

It is very likely for consumers to change the purchase decision when they are introduced to a second option, even without including other benefits.

What were the findings of the test?

- Social proof proved to be the most powerful behavioral bias, having either the largest or second-largest effect in 28 of the 31 tested categories.

- Category heuristics – for best results, it is important to understand which characteristics consumers most associate with a given product or service.

- Scarcity bias proved to be the least effective bias. It could feel restrictive and provoke a negative reaction, especially for exploring shoppers.

- The power of free can be a major influence on behavior, having either the largest or second-largest effect on transfer of preference in 18 out of 31 categories.

- The power of now – the immediate satisfaction of needs didn’t make a huge difference in this simulation, but it still had a meaningful effect on a handful of categories. In fast-moving consumer goods – products like detergents, cereal, and cat food – consumers responded positively to offers of next-day delivery. Same-day delivery had an appreciable effect in the clothing and children’s toy categories.

Supercharging the second-choice brand

Comparing two shampoo options, the second choice introduced was able to take 90% of preference away from the first-choice brand when supercharged with all six biases.

Moreover, all 31 categories in the study had the same result when second favorite brands were supercharged with all six cognitive biases.

Financial services, such as car insurance and credit cards, proved to be among the most susceptible to a transfer of preference, while fast-moving consumer goods, such as moisturizers and breakfast cereal, were among the most resilient.

Starting from nothing scenario

A fictional test was created by Google to asses how much preference share a completely unknown brand might take if it was able to hit all of the identified cognitive biases.

What were the findings of the test?

- The fictional brand, Gem Mobile, was able to take almost 50% of preference from the favorite brand. In other words, agile, intelligent use of behavioral science might give newcomers a major advantage.

- On the other hand, even given the benefits, half of shoppers refused Gem Mobile and opted for their favorite brand, although it was a less appealing offer.

- The only category where shoppers showed hesitancy over switching was the fictional breakfast cereal brand, Honey C’s. Just a quarter were willing to switch from their favored brand, even though the fictitious proposition was full of advantages.

Simulation conclusions

- Therefore, even an unknown brand can change the preference of consumers in the “Messy Middle” stage.

- However, an interesting finding is the fact that many consumers remained loyal to their favorite brand, even though the alternative offered was far more attractive.

- Being present is the first rule in shifting preferences in the “Messy Middle” stage, and sometimes all it takes to make an impact is to show up at the right time.

Transfer of preference from first choice to a fictional brand:

How to emerge triumphant from the “Messy Middle”?

The statistics presented show us that even well-established brands can be vulnerable in this stage. At the same time, for a new brand, this stage can be seen as a window of opportunity, where the efforts made by marketers can have impressive results.

Moreover, for both well-established and new brands, the right approach to marketing in this stage is identical:

Ensuring the brand’s presence

The first step to emerge triumphant from the “Messy Middle” stage is to make the brand visible. Then, it is important to create a connection with customers in explore mode:

- Identify shoppers who are exploring

- Focus on user experience and make it easy for customers to explore you offers

- Present as much information as possible on your products and help the customers make a rapid transition into evaluation and then on towards purchase.

Depending on your category, you can also use other channels to maintain the brand’s presence: price comparison engines, social media, video, news, and relevant content.

Using behavioral science in an intelligent and responsible way

In this process, consumers are extremely focused on evaluation and can be influenced by factors such as the 6 cognitive biases discussed before.

Although the brand affinity and price are undoubted drivers of purchase decisions, consumers can also be strongly influenced by the messages, unique product features and other tactics:

- Identify consumers who are evaluating

- Make sure the messages are tailored to the needs of evaluative shoppers and contain relevant cognitive biases

- Focus on user experience

- Use tactics such as retargeting and basket-abandonment messaging

Closing the gap between trigger and purchase

After all, not every consumer needs to go through exploration and evaluation. If someone has purchased from a brand before and they were satisfied with the experience, they are likely to come back again.

To get the consumers to the purchasing stage as soon as possible, it is important to make sure we facilitate the process of exploration and evaluation and eliminate all the barriers and impediments they may encounter:

- Poor site speed (especially on mobile)

- Inconsistent or unclear messages

- Missing information (particularly missing product details)

- User experience issues – website navigation, pop-ups, limited payment options

In the end, this research provides not only a framework for decoding decisions and navigating the the messy middle, but also a springboard for creativity.

Brands that are able to integrate the lessons of behavioral science into their marketing strategy will have everything they need to thrive. The better brands get at anticipating consumers’ needs for information and guidance, the better user experience will become.